18 April 2019

Pictured: The demonstration took place Saturday in front of Apple’s downtown Montreal location to raise awareness about corporate tax haven use. Twitter photo by Échec aux Paradis Fiscaux and ATTAC-Québec

18 April 2019

Two tax justice groups in Quebec organized a demonstration last weekend to raise awareness about corporate tax haven use. Échec aux Paradis Fiscaux and ATTAC-Québec gathered in front of Apple’s branch in downtown Montreal, demanding Google and other multinationals such as Starbucks pay their fair share. The protest called for tougher penalties on tax haven use and more power for the CRA to conduct investigations. Bravo to both groups for their very successful demonstration, which received extensive coverage across the province in news outlets such as le Journal de Montréal , Radio-Canada, and La Presse.

Ontario budget takes several steps back: Big cuts to Indigenous Affairs and Legal Aid were among some highlights of Ontario Premier Doug Ford’s first budget last week, which also laid out plans to keep spending on education and healthcare at lower levels than experts agree are needed. This budget didn’t include a cut to the corporate tax rate as Ford had said they would do, but they did increase the rates at which businesses can write off the cost of capital investments to match federal changes, which will lower the effective corporate tax rate. The budget also eliminates 0.5% probate fees Ontario charged on the first $50,000 of estates.

Ontario Premier Doug Ford shakes hands with his Finance Minister Vic Fedeli after delivering the provincial budget. Twitter photo

Ontario Premier Doug Ford shakes hands with his Finance Minister Vic Fedeli after delivering the provincial budget. Twitter photo

They did establish a new child care tax credit for families to put towards childcare expenses, but as Global News reported, many critics have pointed out the new credit doesn’t cover the expensive cost of daycare in Ontario and would be challenging for families living paycheque to paycheque.

It points to other provinces such as Quebec and Manitoba that have instead capped childcare costs, a more effective means of reducing income and gender inequality. Just ahead of the budget, other strong progressive policy options for the province were put forth in an excellent report by the Ontario chapter of Canadian Centre for Policy Alternatives.

Challenging corporate tax cuts

UCP leader Jason Kenney gives his acceptance speech after winning the Alberta election Tuesday night.

UCP leader Jason Kenney gives his acceptance speech after winning the Alberta election Tuesday night.

In the final week of the Alberta election, C4TF director Toby Sanger wrote an op-ed scrutinizing a key part of the UCP’s economic platform -- corporate tax cuts. The piece, which ran in the National Observer last weekend, challenges UCP Leader and Premier-elect Jason Kenney’s claims that his proposed corporate tax cuts would create 55,000 jobs and provide a strong stimulus to economic growth. Instead because so many of the most profitable —often oil—corporations in Alberta are substantially foreign-owned, much of the benefits of the corporate tax cuts will go to their foreign owners instead. If Kenney matches corporate tax cuts with cuts to public spending, then economic multipliers show that there will be net job losses and slower economic growth.

Tell Ottawa to end snowwashing:

A new online petition by Leadnow is urging Finance Minister Bill Morneau to strengthen weak corporate transparency laws that allow secret companies to clean their dirty money in Canadian real estate -- an act known as snowwashing. You can add your name to the petition here and please share with others.

Weekend reading list: Thankfully it’s a long weekend because we have an even longer list of must-read columns. This op-ed in the Regina Post-Leader looks at why lower taxes are nothing to brag about. The benefits of higher taxes and increased public services are also explored in this Vancouver Sun op-ed. A Toronto Star column asks why Canada isn’t taxing foreign digital companies such as Netflix to balance domestic competition and help our flailing media industry. The Huffington Post considers whether Canada needs a wealth tax, as Democrats are proposing in the US, and concludes it would be wiser for government fix the leaks and loopholes that allow companies to avoid paying their full share in the first place.

Debunking tax myths:

Debunking tax myths:

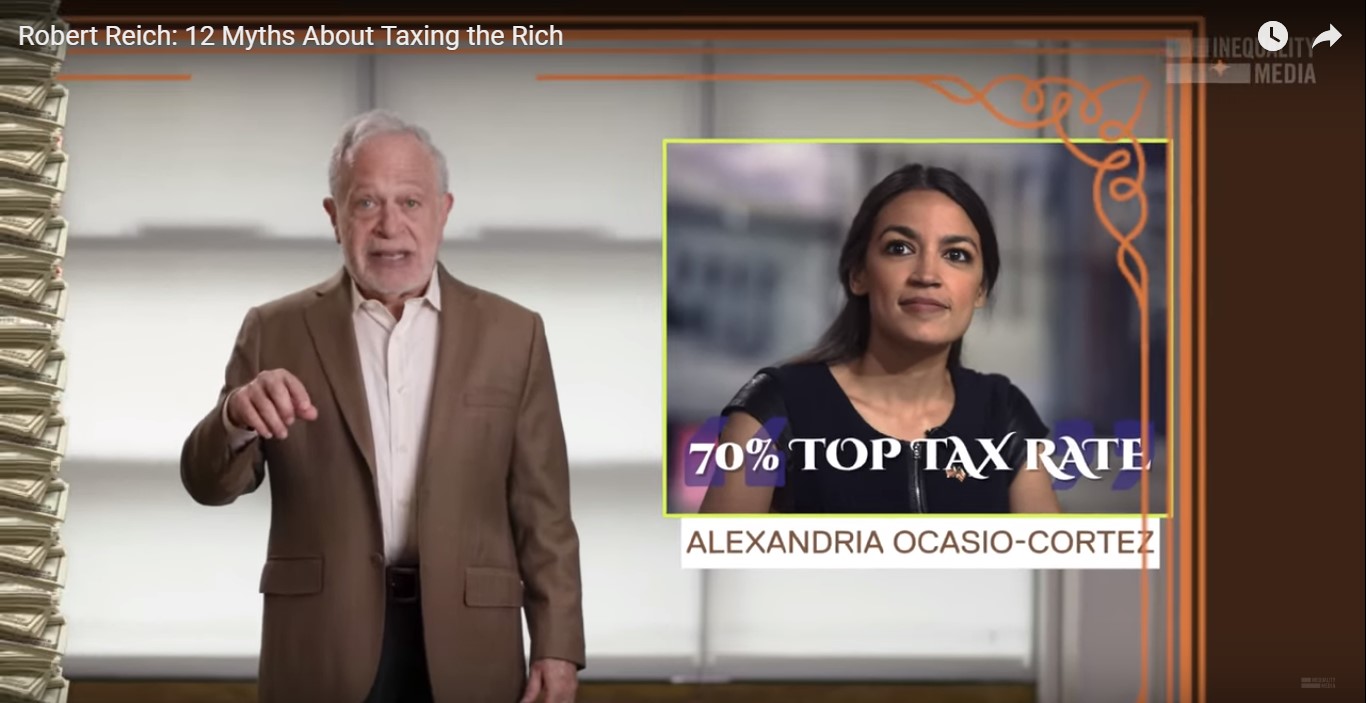

Thanks to one of our supporters who sent in this great short video by political commentator Robert Reich on the 12 Myths of Taxing the Rich. The video clarifies common misconceptions from trickle down economics to the confusion between top marginal tax rates and percentage of income taxed. A perfect introduction to tax fairness concepts for any relatives around the dinner table this long weekend who could use some convincing.

Australia’s new tax law turns a profit: The Australian Tax Office coerced 44 multinationals into returning $7 billion in sales thanks to new tax avoidance laws, the Guardian reported last week. Introduced in 2016, the country’s Multinational Anti-Avoidance Law aims to prevent corporations from shifting profits to tax havens such as Ireland. The tax has led to a bump in revenue for the government, which also recently adopted a diverted profits tax that would slap a 40% punishment on corporations earning more than $1B that practice tax avoidance. A government source told the paper it is considering applying the new penalty to “a handful” of large companies.

To keep our supporters informed and connected, we send a weekly newsletter with highlights of recent progressive tax developments in Canada and around the world. Please sign up here and share this newsletter with others.