Transcript of comments to the House of Commons Finance Committee, during Pre-Budget Consultations for the 2019/20 Federal Budget.

Thank you very much for inviting us. Most come here asking you to spend more money whether through tax cuts or increasing spending in particular areas, but we’re coming here with ways for you to make more money, so I hope you welcome our recommendations!

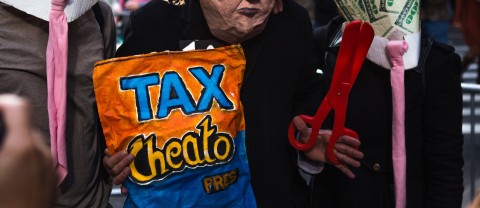

As you are well aware, there’s much pressure from business lobby groups—including the Business Council of Canada, the Chamber of Commerce, the CD Howe Institute and Fraser Institute—to respond to Trump’s tax cuts with additional cuts for business and high incomes in Canada as well.

I strongly urge you not to succumb to this pressure.

The reality is Canada has had declining rates of business investment for the past two decades. Deep cuts to corporate and business taxes have done nothing to stop that, as you can clearly see from the chart included in our submission. Instead business tax cuts have contributed to over $700 billion in corporate surpluses—dead money—that isn’t being reinvested in the economy.

More of the same—tax cuts that primarily benefit large profitable corporations—isn’t going to change this. The tax cuts south of the border are primarily benefiting top incomes and shareholders, with much going into unproductive share buybacks. I’m also skeptical of the economic wisdom of allowing full immediate expensing of capital investments for reasons I’d be happy to explain later.

Instead we should focus on measures that will improve productivity and competitiveness for all businesses, for example a national universal comprehensive pharmacare program.

As a top priority, the federal government must eliminate the tax preferences it provides to foreign e-commerce companies at the expense of Canadian businesses, producers and workers. It's been five years since the OECD first identified this as the top priority in their BEPS Action Plan.

Over 50 nations, including the overwhelming majority of G20 and OECD nations have adopted rules in accordance with OECD guidelines. Despite the loss of tens of thousands of jobs and closure of dozens of media outlets, our federal government is totally missing in action on this issue. Why? Why are we giving blatant tax preferences to foreign digital giants, the largest companies in the world, at the expense of Canadian businesses, Canadian workers, Canadian culture—and at the expense of federal and provincial revenues?

We also urge the federal government to take additional specific actions to crack down on international tax evasion and aggressive tax avoidance, consistent with the OECD’s recommendations. There should be a cap on the interest payments corporations can expense to offshore subsidies and corporations must be required to demonstrate their offshore subsidiaries carry out actual economic activity. The federal government should also invest more in training and technology at the CRA to better combat sophisticated tax evasion, as the Professional Institute of the Public Service has called for.

We were pleased this summer that Federal and Provincial Finance Ministers pledged to improve Canada’s corporate and beneficial ownership transparency rules—another area where we rank very poorly in relation to other G20 countries. Canada is increasingly a destination for money laundering, including through real estate and casinos, with billions lost through tax avoidance. To combat this we need a publicly accessible registry of the beneficial owners of companies. More details are included in our submission.

We also urge the government to follow through on its 2015 election commitment to conduct a wide-ranging review of tax expenditures and cancel unfairly targeted tax breaks. Some action has been taken but much more needs to be done. Most tax expenditures provide greater benefits for top incomes. Eliminating just a few could raise billions in additional revenues and make the tax system fairer.

Finally, we support the federal government’s proposal for a national carbon price backstop, but it should be progressive with measures to ensure that lower and middle incomes are fully compensated for their increased cost, and with border adjustment tariffs so Canadian producers remain competitive.

{Image by Capturing the Human Heart on Unsplash.}