14 January 2021

To subscribe to these monthly newsletters, sign up here

14 January 2021

A new study out of the U.K. has provided further proof that corporate tax cuts have been a multi-billion-dollar failure.

Researchers found 50 years of tax cuts did not create jobs or economic growth and only benefitted the individuals who were directly affected, ultimately increasing inequality. The study should be considered by governments as they look at how to pay for the pandemic, its authors said.

C4TF has long advocated for federal and provincial governments to restore corporate tax rates, which have been nearly halved in the past two decades. Our Corporate Income Tax Freedom Day report last year showed how tax cuts have drained government revenues and deepened inequality.

In a recent op-ed in Policy Options, C4TF Communications Coordinator Erika Beauchesne argues that now is an ideal time for the federal government to reverse these harmful effects, pointing out that American President-elect Joe Biden has promised to restore corporate tax rates in the U.S., giving Canada an opportunity to do the same.

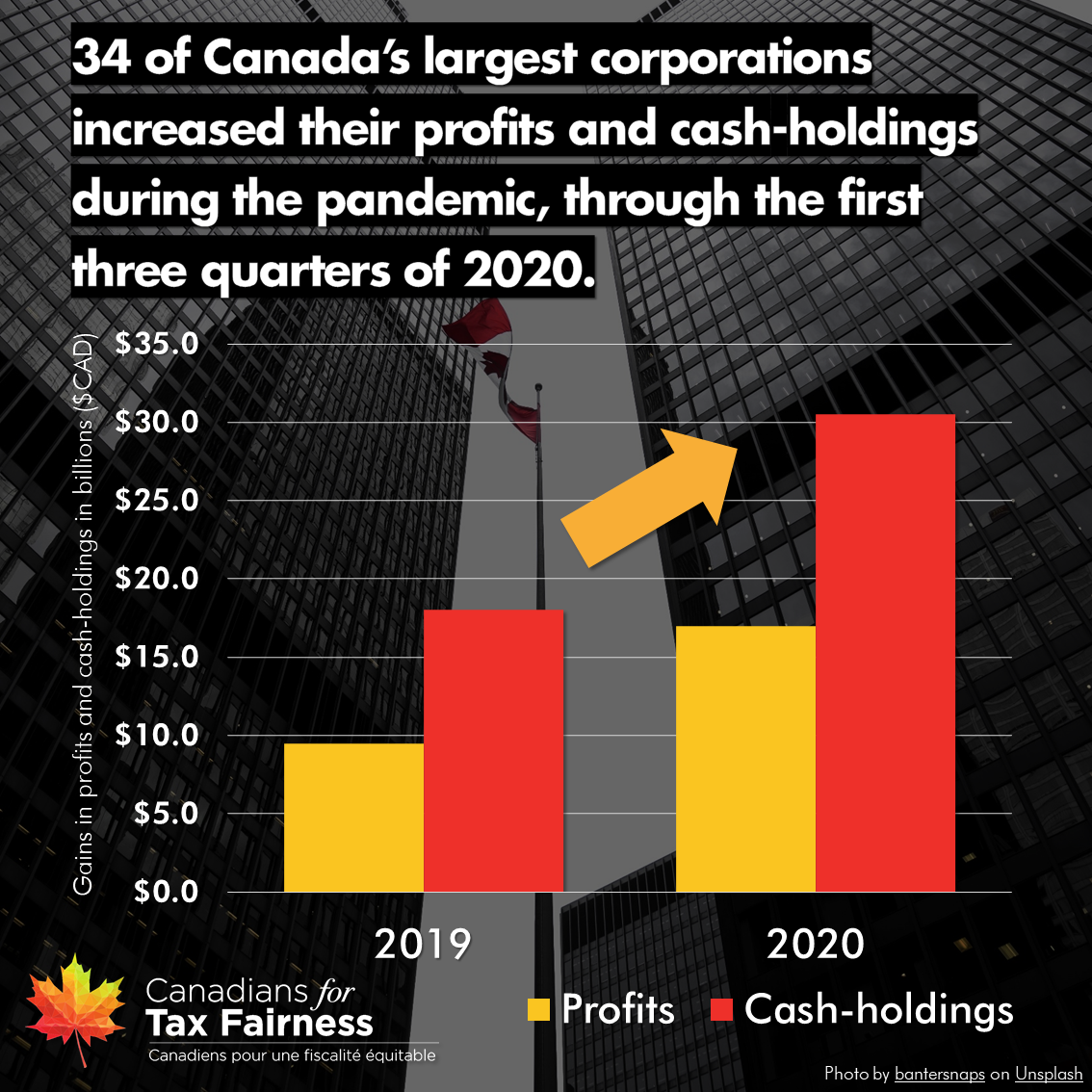

C4TF renews calls for excess profits tax as 34 corporations make record profits

Graphic by Clement Nocos

While Canadian families and small businesses were struggling, dozens of large corporations made record profits, according to a recent report by Canadians for Tax Fairness.

Our report looked at 111 corporations over the first three quarters of 2020. Of these, 34 increased their cash holdings by $11 billion, 19 took in over $1 billion in profits, and 83 others already have profits over $100 million.

The list of profiteers includes large companies that cut pandemic pay for frontline workers and corporations headed by Canada’s top 44 billionaires whose wealth grew by $53 billion during the pandemic.

The report was authored by C4TF’s new researcher, DT Cochrane, who told media the findings raise questions about how Canada’s largest corporations make their profits and how wealth disparity is tied to excess corporate power and profits.

C4TF is renewing calls for an excess profits tax to make large corporations pay their fair share during the crisis, restore corporate tax rates, and improve transparency around corporate and government spending. More than a dozen of the very profitable corporations used federal public subsidies such as the Canada Employment Wage Subsidy (CEWS) to boost profits for their shareholders and billionaire owners. C4TF director Toby Sanger called on the government last March to attach conditions to federal aid to prevent this type of profiteering.

The Financial Post also recently reported 68 Canadian corporations paid out billions to shareholders while receiving CEWS. One of the reporters who investigated the story wrote a poignant op-ed about the inequality of a system that allows public aid to pay out dividends to wealthy shareholders.

For third year in a row, Canadian CEOs take home 200x average worker pay

Corporate subsidies like CEWS can not only be used to pad the profits of shareholders but to bolster excessive compensation for Canada’s top paid corporate executives.

The Canadian Centre for Policy Alternatives recently released their annual report on CEO pay, which found average total compensation for Canada’s 100 top paid CEOs was $10.8 million – more than 200 times the average worker’s annual salary.

More than a third of Canada’s top paid corporate executives belong to companies that received government funding through CEWS, the report found. CCPA Economist David Macdonald estimated that based on company share performance, half the country’s top paid CEOs will continue to see their compensation increase despite the pandemic.

C4TF recently wrote about how the federal government can curb excessive CEO pay and prevent public funding from being used by corporate and billionaire profiteers. We propose several short and long-term tax reforms, such as closing tax loopholes for rich executives and introducing a wealth tax on fortunes over $20 million.

Read our latest op-ed outlining the case for a wealth tax in Canada and this piece by an Ontario doctor about why wealth inequality affects the well-being of all Canadians. Check out this Bloomberg article about the global momentum building to tax the rich and help pay for the pandemic.

Major steps to improve corporate transparency should prompt Canada to act

The U.S. just introduced a new law banning anonymous corporations in an effort to crack down on money laundering, tax evasion and other financial crimes. The Corporate Transparency Act requires corporations to disclose their ultimate beneficial owners through a central register. While the legislation is good news for Americans, it’s a warning that Canada needs to join its international peers and strengthen weak corporate transparency laws that can be exploited by criminals.

As we recently pointed out in a Toronto Star op-ed, Canada lags behind more than 50 countries that already have or committed to establishing a public registry of corporate beneficial owners.

The Canadian government wrapped up consultations on a public registry last spring, but has made no progress since then, even as provinces are taking action to combat crime through shell companies.

The B.C. government just introduced its beneficial ownership of property while Quebec recently tabled legislation to create a public registry of corporate owners. Even New Brunswick –one of the most secretive jurisdictions in Canada—announced plans to require companies maintain beneficial ownership information after an investigation traced shell companies in the province to international criminal activity.

With the increase in COVID-19 related fraud and government spending, it’s more important than ever that Canada move ahead with a public registry.

Ottawa’s new climate plan is positive progress, but more needs to be done

The Liberals recently unveiled a new climate action plan, which includes raising the carbon tax and investing in green infrastructure and technologies. In a release, C4TF welcomed these steps, but called for stronger action.

Canada’s carbon tax is progressive with most households receiving more in climate incentive payments than they pay in tax. The government now plans to make these payments quarterly, which will help families, but more must be done to ensure the neediest Canadians receive rebates. One in 10 individuals do not file their taxes and therefore do not receive important benefits such as the climate action incentive payment. The Liberals must follow through on their commitment to bring in automatic tax filing to make sure vulnerable individuals receive these important payments.

While a price on carbon is important in the fight against climate change, it is only one tool in the toolbox. The Liberals’ current plan does not go far enough, leaving many large emitters off the hook. Canada should convert its opaque cap and trade system for industry to a transparent carbon tax with border adjustments for exports and imports. It’s also time to finally eliminate fossil fuel subsidies.

CRA’s latest Tax Gap Report shows compliance efforts pay off

Investments to improve tax compliance provide returns to the public purse, according to the latest Canada Revenue Agency Tax Gap Report. The tax gap reflects how much tax owed to government compared to how much it has collected.

According to the report, Canada’s total payment gap declined by 59% between 2014 and 2019, a period when government restored funding for the CRA after steep cuts by the Harper government. It’s not the first report to show investments in tax compliance pay off. A PBO report last year found that for every additional dollar of funding for CRA’s business compliance programs since 2015-16, the government generated nearly six dollars in fiscal impact.

Despite these improvements, more investments are clearly needed for corporate tax compliance. The Tax Gap report found that the pay gap for individual filers decreased by 76%, but the gap for corporations only declined by 38%.

As C4TF director Toby Sanger told iPolitics, the CRA should focus on where the money is and put more efforts into compliance measures for large corporations.

In a media release, C4TF applauded the CRA for publishing these tax gap reports, but called for greater government action and corporate transparency to narrow Canada’s corporate tax gap.

C4TF hires new researcher to advance tax fairness campaigns

Canadians for Tax Fairness director Toby Sanger and Communications coordinator Erika Beauchesne are excited to welcome a new staff member to their team, researcher D.T. Cochrane.

A father, partner, and economist with a vested interest in social justice, Cochrane specializes in corporate and financial research. He has worked with organizations including Indigenous Network on Economies and Trade, Mining Watch Canada, the Blackwood Art Gallery, and others.

With a masters in Economics and a Doctorate in Social and Political Thought, Cochrane also teaches Business and Society courses on a range of issues from globalization and finance to market theory and corporate governance.

Cochrane grew up on a ranch in Saskatchewan on Treaty 4 territory and now lives in Ontario with his family. Before having children, he was an avid photographer with prior work experience in media analysis. Beyond his role as a researcher, Cochrane’s advocacy work has also included writing opinion pieces on issues such as a Green New Deal, federal financing and Indigenous rights. His op-eds have been published in various outlets, several of which can be found at theconversation.com.

Cochrane will focus on various tax fairness campaigns this year, with a focus on corporate taxes and accountability as well as the role taxation plays in addressing inequality.