3 November 2020

Sign up to receive these monthly newsletters

Federal Finance Minister Chrystia Freeland is expected to deliver a fall fiscal update later this month. Photo: Chrystia Freeland Twitter

3 November 2020

By Erika Beauchesne

C4TF seeking tax fairness measures in upcoming fall fiscal update

In the federal government’s fall fiscal update we’ll be looking for the Trudeau government to follow up on fair tax commitments they made in the September speech from the throne, including tax measures to address extreme wealth inequality.

The need for action is more urgent than ever. Two recent reports show the divide between the rich and poor in Canada is getting worse under the pandemic.

Canadians for Tax Fairness communications coordinator Erika Beauchesne recently published an op-ed in the Hill Times outlining different tax policies the government should use to reduce inequality, including closing tax loopholes, introducing an annual wealth tax, and an excess profits tax on large corporations that have profiteered from the pandemic. We were pleased to see the NDP recently propose an excess profits tax, along with other progressive tax reforms, that would target inequality while generating billions to help pay for COVID-19 and critical public services.

It’s becoming clearer that now is the time to make those investments. The Bank of Canada recently announced interest rates will remain at record lows until at least 2023, allowing government to spend significantly on programs that will help individuals, communities, and economies recover from the pandemic. The IMF also recently recommended that increasing public investment will help create millions of jobs and “revive economic activity from the sharpest and deepest global economic collapse in contemporary history.”

New polling from Environics Research shows the majority of Canadians support the government in making “major changes to fix long-standing problems in society” such as inequalty. Another poll in Quebec found the majority of Canadians are willing to pay more in taxes.

Homeless woman in Toronto, Photo Joshua Sherurcij, Creative Commons.

Reforms needed to ensure vulnerable receive benefits they’re entitled to

Canadians for Tax Fairness will also continue to push for the government to follow through on their throne speech promise to introduce automatic tax filing for vulnerable Canadians. Millions lose out on benefits due to barriers when it comes to filing their taxes. Automatic tax filing will help bridge some of these gaps, but additional investments are needed to improve how vulnerable individuals engage with the tax system.

The homeless, Indigenous peoples, undocumented individuals, disabled, seniors, and unbanked persons encounter many obstacles in filing their taxes and receiving benefits. While automatic tax filing is an important step, the government will need to strengthen other resources, such as internet access, education and outreach to help individuals who need it most. A recent CBC news story explored the challenges Canadian sex workers face when it comes to filing taxes and receiving important benefits, especially in a pandemic that has affected their employment.

Making taxes easier to file isn’t the only fix needed. According to a report by Canadian Press, a federal government study showed that lower-income workers are clawed back more in taxes and benefits for extra earnings – even more than those at the top. The report has renewed calls from tax experts for a sweeping review of the tax system to ensure it delivers help to those who need it and does not disincentivize worker participation. As anti-poverty advocates pointed out, a review should also consider other factors that influence work decisions such as the cost of childcare and access to benefits.

These examples underline why any review of Canada’s tax system must include input from marginalized communities, vulnerable individuals, and lower-income workers.

Two significant corporate tax dodging cases are heading to the Supreme Court of Canada. Photo: Judges of the court, Supreme Court of Canada photo collection

Supreme Court to settle major billion-dollar corporate tax dodging cases

The Supreme Court of Canada has granted the Canada Revenue Agency (CRA) leave to appeal a case involving Loblaw and the food retail giant’s use of a banking subsidiary in Barbados to avoid hundreds of millions in Canadian taxes. The ruling would have implications for over a billion in related cases, according to the CRA.

The CRA won the Loblaw case at the Tax Court of Canada, but then the Federal Court of Appeal sided with Loblaw this past April. This will involve the first major court case dealing with Foreign Accrual Property Income (FAPI) rules, meant to prevent corporations from avoiding tax on income from “passive” activities.

Loblaw used the profits from their Barbados Bank to buy up Shoppers Drug Mart, further establish their position as Canada’s dominant food retailer, and add to the multi-billionaire Weston family fortune.

The CRA argued that to let the appeal court decision stand would be “absurd” and provide a roadmap for tax dodging for other banks and corporations. It was good to see the CRA cite comments from Canadians for Tax Fairness and other tax experts in their arguments. Our advocacy makes a difference!

The CRA has also applied to the Supreme Court to hear another significant case, this time involving Cameco with over $2 billion in taxes and interest owed. The Saskatchewan-based uranium giant used a Swiss subsidiary to avoid billions in Canadian taxes. This case will be a major test of transfer pricing rules. We and Saskatchewan Citizens for Tax Justice urged the Revenue Minister to appeal this case, so we’re glad they finally have.

While it is important to fight these cases in court, it is even more important for the federal government to reform its tax laws to prevent this type of corporate tax dodging in the first place by removing ambiguities in the law and avoiding expensive and lengthy court battles.

Reforms will also need to address other outrageous corporate tax manipulations that are happening, including multinationals now shifting their losses to Canada to take advantage of our more generous tax credits and get paid money back by our governments.

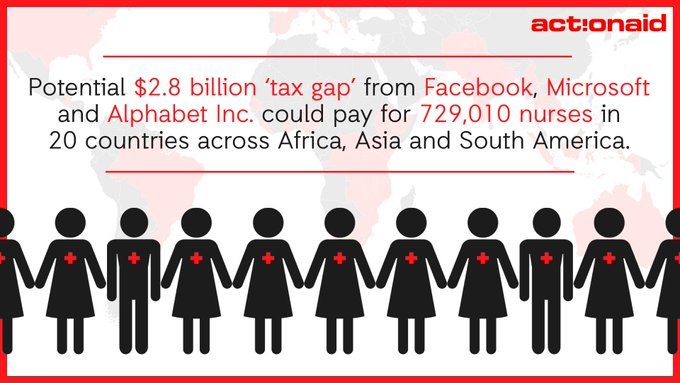

A new report found a potential tax gap of $2.8 billion from three digital giants. Photo: ActionAid

Tech giants dodging $2.8 billion in poorer countries: report

Tax dodging by Facebook, Microsoft and Alphabet could be costing poorer nations at least $2.8 billion in lost tax revenues, according to a new report by ActionAid.

Billions in foregone revenues from just those three big tech companies alone could fund more than 1.7 million nurses across 20 developing nations within three years, the international development organization calculated.

Internet giants have had their profits and stock prices soar during the pandemic, but the same corporations have been able to avoid taxes under outdated international tax rules. The report recommends bringing in a global minimum tax rate and stronger reporting requirements to prevent tax dodging by digital corporations.

The OECD has failed to reach a global consensus on reforming international corporate tax rules, with their proposals watered down and no deal expected for at least another year. Tax justice advocates have pointed out that in the current crisis, countries can’t afford to wait for a consensus that only marginally reforms global tax rules when more fundamental changes are needed. Without a global deal, countries should act unilaterally to make these companies pay their fair share of taxes, and to put pressure on other countries and corporations to agree to substantial reforms.

These should include unitary taxation of multinationals, allocating taxable income between nations based on their real economic activity, and a global minimum tax.

The Tax Justice Network just released an excellent video (available in English and French) explaining how unitary taxation would work to prevent multinationals from avoiding taxes, while Public Services International also recently published a series of briefings on how governments can address corporate tax avoidance. These include public country-by-country tax reporting for multinationals and strengthening resources for tax authorities.

We also need stronger enforcement. A recent report by Canada’s Parliamentary Budget Officer found increased funding of Canada Revenue Agency’s business tax compliance program generated nearly six dollars in fiscal impact for every additional dollar of funding since 2015-16.

The TaxCOOP2020 Summit was the largest tax conference of the year with more than 130 speakers and 2,300 attendees. Photo: TaxCOOP

Tax justice issues at forefront of TaxCOOP World Tax Summit

Canadians for Tax Fairness was excited to participate in the biggest tax conference of the year, the TaxCOOP World Tax Summit. The virtual summit was hosted in Montreal and focused on wealth distribution and tax cooperation – timely subjects amid the COVID-19 crisis.

More than 2,300 people attended the summit, which heard from over 100 guest speakers including prominent politicians, tax experts, academics, CEOs, researchers and activists. C4TF director Toby Sanger closed out the conference sessions in a panel on tax justice with Huguette Labelle, former president of the board of Transparency International. They discussed the need for increased corporate transparency and accountability to tackle offshore tax evasion and combat corruption.

Videos of the panel and others from the summit will be available later in both English and French online. The summit concluded with the release of an outstanding documentary by economist and TaxCOOP organizer Brigitte Alepin. Fast and Dangerous: Race to the Bottom looks at how lower taxes and tax avoidance has cost society and the economy.

International criminals continue to use the Canadian economy to launder their dirty money. Photo: Pixabay

International criminals continue to use the Canadian economy to launder their dirty money. Photo: Pixabay

B.C. inquiry into money laundering resumes amid new scandals

After a pause for the provincial election, the Cullen Commission has restarted its public inquiry into money laundering in B.C.

C4TF and coalition partners Transparency International Canada and Publish What You Pay Canada testified at the inquiry earlier this year. To stop money laundering, we’ve called for requiring transparency of the true—or “beneficial”--owners of companies. Establishing a public registry of beneficial owners can deter criminals from using shell companies to launder their dirty money, what’s known in Canada as ‘snow-washing.’

The inquiry resumes on the heels of a recent international investigation into illicit financial transactions that found Canada ranked 7th among countries for suspicious activity reports, with a number of Canadian banks and companies linked to the suspicious movement of money across borders.

The FinCEN Files investigation also showed how New Brunswick is one of the worst provinces when it comes to corporate secrecy and the ease of international criminals setting up a shell company to launder money. In response to the story, the Conservative Premier of N.B. has promised to review corporate rules in the province, which are far behind other jurisdictions, such as B.C. and Quebec, which are moving towards greater transparency.

Corporate secrecy has not only fuelled Canada’s money laundering problem, but made us complicit to corruption on a global scale. A recent report by Transparency International found Canada ranks among the worst global exporters when it comes to enforcement against foreign bribery, falling behind OECD peers such as the U.S. and the U.K. The report makes a number of recommendations, including increasing funding and resources to investigate corruption cases and creating a public and centralised register of beneficial ownership information.

Alberta Union of Provincial Employees protested the UCP government’s cuts to jobs and public services this week. Photo: AUPE Twitter

Alberta Union of Provincial Employees protested the UCP government’s cuts to jobs and public services this week. Photo: AUPE Twitter

United Conservative Party tax cuts continue to fail Albertans

Alberta is still struggling more than a year after Premier Jason Kenney brought in tax cuts for large corporations that were promised to create jobs and stimulate investment. Instead, thousands of jobs have been lost, multiple investors have pulled out of the province, and deep cuts to public services and jobs—in part to pay for the tax cuts—have contributed to a “brain drain” of Alberta talent to other provinces, such as B.C.

Corporate tax cuts fail to do their job in the best of times. In a pandemic, when many small and medium-sized businesses are struggling, they make even less sense. In recent weeks, major energy companies Cenovus, TC Energy Group and Suncor all announced plans to cut thousands of Alberta jobs – losses that coincide with large-scale public sector job losses under the UCP, and in the midst of this pandemic is planning thousands more to the healthcare system.

An excellent op-ed in the Edmonton Journal recently explored how introducing more progressive taxes, investing in quality public sector jobs, and diversifying the economy would be a better course of action to help the province get back on track.