13 septembre 2019

To keep our supporters informed and connected, we send a newsletter with highlights of recent progressive tax developments in Canada and around the world. Sign up to receive our newsletter here.

Photo credit: Elections Canada

Vote for tax fairness kicks off

With the federal election officially called, Canadians for Tax Fairness this week launched its campaign for progressive tax policies. Our supporters voted for their top five tax fairness measures and closing tax loopholes headlined the list. We start by highlighting how these tax breaks are not only ineffective, they’re expensive. Tax loopholes also contribute to wealth inequality by paying out mostly to the richest Canadians, as C4TF director Toby Sanger emphasized in a feature story on tax loopholes by the Tyee this week.

We encourage you to share our fact sheet [printable PDF version here] that shows how closing just the most regressive loopholes could raise at least $16 billion a year. That works out to $1,000 in the pocket of each Canadian household, enough to provide a national pharmacare program or eight million childcare spaces. We’re also asking supporters to send a message to party leaders that it’s time to close regressive tax loopholes. Stay tuned as we promote other tax fairness measures in the coming weeks and how you can make tax fairness part of the conversation this election. Read more about these proposals in our Platform for Tax Fairness and recent pre-budget submission to government.

The stock option deduction costs the federal government an estimated $700 million in revenues annually, and costs provinces another $300 million for a total cost of over $1 billion. Photo: John Lawlor, flickr

Add your voice to stock option consultations

Canadians have until September 16 to weigh in on the government’s plans to limit one of the most regressive tax loopholes, the stock option deduction. You’ve probably heard about this tax break in the news as more high-profile executives have cashed out millions in shares and paid taxes on only half of their profits. The federal government announced in its 2019 budget that it plans to cap the deduction limit to $200,000 for mature companies. While we welcomed their plans to restrict the billion-dollar loophole, there is no good reason why profits should be taxed any differently than the ordinary income of workers. This week, we submitted comments to Finance Canada arguing it’s time to completely shut down the billion-dollar loophole. We encourage supporters to send a similar message by emailing: fin.ESO-OAAE.fin@canada.ca

NDP leader Jagmeet Singh speaks to media this week as federal parties launched their campaigns. Twitter photo

NDP wealth tax could raise nearly $70B: PBO

The federal NDP’s proposed wealth tax could rake in almost $70 billion in additional revenues over 10 years, according to an analysis released this week by the independent Parliamentary Budget Officer.

Early this summer, the NDP announced its plans for a 1 percent tax on very rich households with more than $20 million in assets. The PBO estimates the tax could bring in $5.6 billion the first year and increase over 10 years to a total of $68.6 billion – revenues the party says it would put toward health care and housing.

In this Press Progress story, C4TF director Toby Sanger notes the PBO figures are pleasantly surprising, but not far off what the International Monetary Fund has calculated in previous studies on the potential revenues of a wealth tax.

The NDP’s platform includes other progressive tax policies such as increasing the rates at which capital gains are taxed from 50 percent to 75 percent. So far it is the only party to include a wealth tax in its election promises, despite polls that have found the majority of Canadians support such a tax.

In the past year, wealth taxes have gained popularity south of the border, where Massachusetts Senator Elizabeth Warren has proposed a 2 percent tax on net worth over $50 million. Her tax is estimated to generate $2.75 trillion over 10 years.

The economists behind Warren’s plan released a paper last week shooting down some of the common arguments used by wealth tax critics. In another paper earlier this summer, they dispelled doubts over how much the tax could generate due to tax avoidance by the very rich. Their estimates were confirmed in a separate independent study by tax experts this week.

It’s encouraging that the NDP has come out with a policy that addresses inequality and the need for increased social services. We hope to see similar proposals from all parties in the weeks ahead.

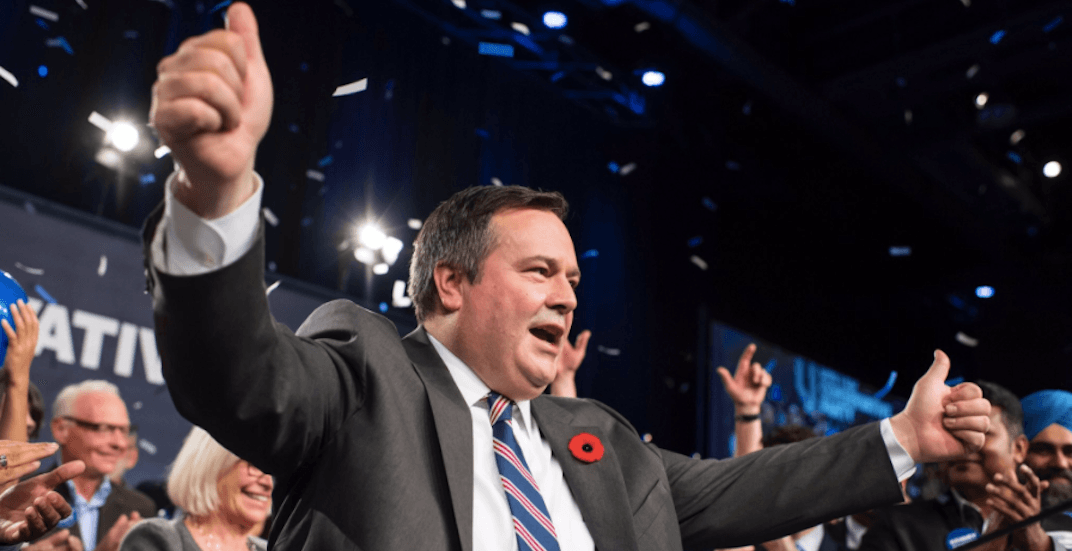

Jason Kenney’s Conservative government in Alberta is looking for places to cut spending. His government-appointed panel is eyeing healthcare, education and the public sector. Twitter photo

Austerity could worsen Alberta’s economic woes

Critics are cautioning against the looming cuts to social programs in Alberta under Conservative Premier Jason Kenney. A government-appointed panel warned earlier this month the province would need to cut spending by $600 million to deal with its debt, but ruled out raising taxes to help pay for it. Instead, the panel turned its focus to sectors such as healthcare and education.

But as the lowest-taxed province in Canada, “Alberta’s real difficulty in balancing the books lies in its anemic tax effort,” the Parkland Institute said in a statement. The non-partisan research centre released a paper pointing out the province’s heavy reliance on the fluctuating oil sector has fuelled its money troubles while provincial social services spending has been relatively flat.

An excellent op-ed in the Star this week echoed some of the institute’s points, noting that nowhere in the panel’s report is there any mention of climate change or other facts governments would be wise to consider in their spending decisions. It cautioned that cuts to social programs will not help revive the economy and instead result in widespread job losses that negatively impact every sector.

Canadians for Tax Fairness has been very critical of Jason Kenney’s plans to slash Alberta’s corporate tax rates. This will overwhelmingly benefit large profitably corporations, many of which are foreign owned, and cost the province over $1.75 billion annually -- equivalent to $1,000 per Alberta family.

IMF finds one-third of foreign direct investment is tax dodging

A handful of notorious tax havens including the Netherlands, Ireland, Luxembourg, Bermuda and Switzerland host more than 85 percent of the world’s ‘phantom’ foreign direct investments (FDI), says a new study by the International Monetary Fund.

Phantom investments –essentially tax avoidance through corporate shells-- are growing rapidly, the study found. Phantom FDI has not only outpaced genuine investment but now accounts for an estimated $15 trillion – a third of all FDI. While tax havens host most of these phantom investments, every jurisdiction in the world is now affected by the “phenomena” that reduces corporate tax bills without genuinely contributing to the economies of host countries.

The IMF findings even spurred an editorial in the business-friendly Financial Times aptly titled “Phantom investment calls for an exorcism.” It warns “capitalists should be worried” about corporations that play hide and seek with tax authorities because they tilt the playing field and hinder business competition.

This latest analysis underlines the pressing interest of all countries –from developing, emerging and advanced economies-- to support international reforms to corporate tax rules, as C4TF has argued.