8 décembre 2020

Sign up to receive these monthly newsletters

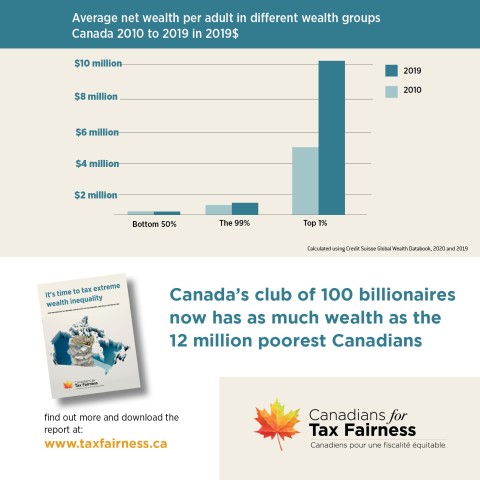

C4TF recently released a report that found Canada’s billionaires increased their wealth by 28% during the pandemic, adding $53 billion to their fortunes at a time when millions of Canadians are struggling to get by.

Our report provided further evidence on how inequality has worsened over the past decade, especially at the very top end, and showed how the federal Liberals could meet their throne speech commitment to reduce tax extreme wealth, including introducing a wealth tax, an inheritance tax, closing tax loopholes for the rich, and cracking down on tax haven use by wealthy individuals. Read our media coverage in le Journal de Montreal, the Financial Post, the Huffington Post, and Yahoo News, and Jacobin magazine. The report was also covered by Radio-Canada and dozens of local CBC radio stations across the country.

We’ve been working hard to keep this important issue in the news. C4TF director Toby Sanger and Broadbent Institute policy advisor Andrew Jackson published an article in the latest Canadian Tax Journal advocating for a wealth tax and C4TF communications coordinator Erika Beauchesne recently wrote about the need to tax the super-rich in the National Observer. Our chart on rising wealth inequality in Canada was also featured in the annual Maclean’s charts to watch in 2021.

Pressure is building on the government to tax extreme wealth. The federal NDP is continuing to push for a wealth tax while a new poll by Abacus Data found public support is growing with 8 out of 10 Canadians now behind taxing the very rich, including respondents of all ages, income levels and political lines.

Addressing extreme wealth concentration has become a global priority. New international data from the World Inequality Database found inequality is on the rise, although some regions are doing better than others. In terms of pre-tax top 10% income shares in 2019, Australia (35%) and New Zealand (37%) remain significantly more equal than Canada (43%) and the US (45%) yet Canada ranked worse than the U.S. in terms of transparency of wealth and income inequality.

Governments at all levels are recognizing that new tax measures are needed to reduce the inequalities that the pandemic has exacerbated. San Francisco recently followed in the footsteps of Portland, Oregon and introduced a tax on corporations that pay their executives 100 times more than their average worker. The CEO tax is expected to generate between $60 million to $140 million per year.

To help pay for COVID-19’s rising costs, Argentina recently approved a millionaires’ tax on those with assets over $200 million pesos (US$2.4 million).

Finance Minister Chrystia Freeland delivered her government’s fall economic statement, which included some fair tax commitments. Twitter

Fair tax commitments in federal economic statement welcomed but more action needed

Canadians for Tax Fairness was encouraged to see a number of tax fairness commitments in federal Finance Minister Freeland’s fall economic statement last week. They include a number of measures C4TF has long campaigned for, so we we’re happy to see progress with these commitments, but more action is needed.

Most importantly, the federal Liberals pledged to introduce a digital tax on foreign internet giants, require e-commerce companies to collect and remit sales tax in Canada, and apply the GST to goods shipped from Amazon-style “fulfillment warehouses”. These long overdue measures will finally help to level the playing field for Canadian companies while generating significant revenues for federal and provincial governments. Quebec brought in e-commerce tax fairness measures two years ago, while many other countries, including France are taking unilateral action to tax big tech in the absence of a global consensus.

The fall economic statement included proposals to limit the stock option deduction, one of the worst tax loopholes for the rich. However, they could raise much more revenue by closing this loophole entirely and eliminating many other costly loopholes such as the lower rate on capital gains.In addition to providing more funding for the Canada Revenue Agency to tackle offshore tax evasion, the Liberals also announced plans to strengthen legislation to prevent tax avoidance through general anti-avoidance rules (GAAR). Canada’s existing rules are clearly inadequate, as we’ve seen with Cameco and Loblaws winning at court against the CRA. C4TF has called for many years for the federal government to strengthen its anti-avoidance laws by including economic substance rules, which former MP Murray Rankin adopted in his private members Bill C-362. We’re glad the federal government is now moving forward on this.

The fall economic statement also revealed that the federal debt is expected to almost double to over $1.4 trillion within a few years. While it is manageable, the federal government will need higher revenues to pay for the costs of the crisis and recovery. We need to ensure that these come from progressive taxes from the larger corporations and wealthy who can afford to pay more, and not from regressive taxes that would make inequalities worse.

The federal government could generate tens of billions in additional revenues from closing tax loopholes, tackling tax havens, taxing extreme wealth and restoring taxes on corporations. The fall economic statement took some steps in this direction: we’ll continue to push for more ambitious strides in future budgets.

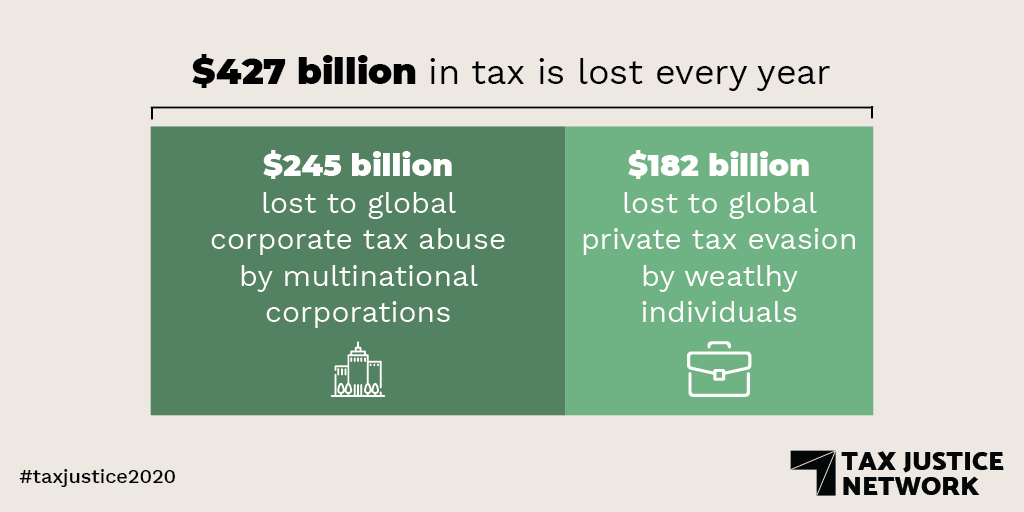

A new report by Tax Justice Network has calculated the global cost of tax dodging. Graphic by TJN

Over $560 billion in global revenues lost to tax havens: Tax Justice Network study

Global corporate tax dodging and tax evasion costs governments more than C$560 billion annually, according to a new study by the Tax Justice Network (TJN).

TJN used information recently released by the OECD to calculate how much countries are losing to tax avoidance and evasion. Their study estimated that Canada loses at least C$7.9 billion a year, an amount equal to the salaries of over 100,000 nurses.

When broader tax losses are considered, including the race to the bottom in lower corporate tax rates, we lose even more -- between C$12.5 billion to C$68 billion annually. By enabling corporations to dodge taxes in other countries, Canada also contributes to $10.5 billion in lost revenues for those countries, often lower income developing countries.

Unfortunately, Canada ranks very low globally on corporate transparency, and the actual losses are likely higher than these estimates. We’re a haven for international money launderers who can set up anonymous shell corporations, we have little transparency over corporate finance and taxation, and the Canadian government hasn’t made public or shared information on country by country reporting by multinationals.

In a media release, C4TF called on the Canadian government to step up its efforts against corporate tax dodging and endorsed the report’s recommendations for governments to introduce an excess profits tax and require country by country reporting for multinationals.

TJN hosted a webinar about their findings and how to address global tax dodging. You can watch it here.

With women overwhelmingly disadvantaged by the pandemic, the need for government investments in affordable childcare has been never greater. Photo: Pixabay

With women overwhelmingly disadvantaged by the pandemic, the need for government investments in affordable childcare has been never greater. Photo: Pixabay

Experts point to benefits of investing in public services

A new report from the Centre for Future Work, written by C4TF Technical committee member Jim Stanford, has found that investing in a national childcare program would “pay for itself” by raising $29 billion a year in additional tax revenues through new income, extra spending and reduced social costs.

An accessible and affordable national childcare program could result in as many as 726,000 women joining the labour force over a 10-year period, the report found. The investment also has the potential to create tens of thousands of additional jobs in construction.

Women have been disproportionately hurt in this economic crisis, which was first dubbed a “she-cession” by economist Armine Yalnizyan, who is also a member of C4TF’s technical advisory committee. In their recent fall economic statement, the federal Liberals committed to a create a national childcare program to help more women join the workforce, but some have pointed out the plan does not move fast enough.

More experts are urging governments to make critical public investments now to stimulate job creation and rebuild a more inclusive and sustainable economy. The IMF recently urged that this moment in history offers a radical window for change in areas such as creating higher-quality jobs and improving social protections.

A recent piece by C4TF advisory board member (and former clerk of the federal privy council) Alex Himelfarb looks at how COVID-19 debt is no reason to panic, but rather an opportunity to fix what’s broken, including creating a fairer tax system.

Ontario Finance Minister Rod Phillips speaks in the legislature. The province recently unveiled its 2020 budget in November . Photo: Twitter

Ontario Finance Minister Rod Phillips speaks in the legislature. The province recently unveiled its 2020 budget in November . Photo: Twitter

Ontario’s budget focusing on tax cuts for business could make pandemic worse

While some governments have recognized the urgent need to strengthen social security nets in the pandemic, others are focusing instead on tax cuts for business with the potential of dangerous repercussions Canada goes through another bigger wave of COVID infections. Ontario Conservative Premier Doug Ford recently delivered a budget that put businesses first but offered little in the way of new investments to improve public safety.

The province plans to pour over a billion into cutting the electricity costs of medium and large-sized industries. One analysis found the budget’s total tax cuts could amount to businesses receiving $875-million in tax cuts in the 2021-21 fiscal year. As the opposition pointed out, tax cuts in a pandemic when mainstreet businesses are struggling, don’t make much sense.

Ontario also quietly passed new rules allowing realtors to incorporate and take advantage of paying less tax, which will result in tax unfairness and significant revenue losses at provincial and federal levels. At a time when governments need additional funds to protect the public, introducing more tax cuts and tax loopholes is a poor strategy.

Canadians in other provinces such as Alberta are already seeing firsthand the tragic consequences of inadequately funding public services in order to pay for tax breaks for big business.