29 avril 2021

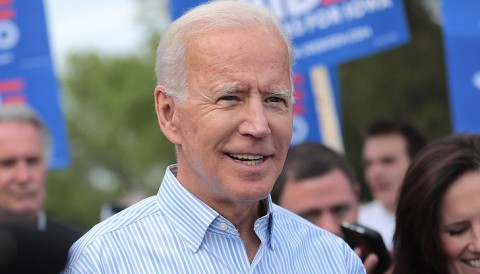

Photo by Jihervàs on Flickr (CC)

Thursday, 29 April 2021

With his first 100 days in office as yet to pass, US President Joe Biden is moving without delay to introduce significant progressive tax reforms, which would end and reverse the decades-old race to the bottom on corporate taxes, and increase taxes on the wealthiest American households.

The trillions of dollars in new revenue would, if the proposals are approved by the US Congress, create millions of jobs, rebuild infrastructure, facilitate the transition to a low-carbon economy, provide free childcare and free community college, paid sick leave, reduce poverty, and provide tax breaks and income assistance for people with lower and middle-class incomes.

President Biden is moving forward much more forcefully on progressive taxation than anyone expected, providing an inspiration for others, and challenging other countries, including Canada, to follow his lead.

Biden’s tax plans were delivered in two parts: the first, his Made In America Tax Plan, released in March, focused on domestic and international corporate tax reforms; the second, his American Families Plan, released April 28, focused on increasing taxes on the richest portion of the top 1% of American households, in order to pay for expanded public services and benefits for low and middle income families.

The Made In America Tax Plan proposes to:

- Restore the US federal Corporate Tax Rate to 28% from the 21% rate that Trump cut it to in 2017. This would still be below the 35% nominal rate that it was until 2017, but by closing loopholes the effective rate could be similar. A US federal rate of 28% will be much higher than Canada’s federal rate of 15%, and higher than the combined federal-provincial rates in every province across Canada.

- Introduce a Minimum Tax Rate of 15% on Large Corporations Book Income. A number of large corporations report book profits to their investors but avoid paying tax because they make use of different tax loopholes and expenditures. This measure would prevent that kind of blatant tax avoidance.

- Increase and Strengthen the Global Minimum Tax to 21% that applies to the foreign income of US multinationals, from the current rate of 10.5% - and even that rate is subject to large exemptions. Biden and Treasury Secretary Janet Yellen have urged and challenged other countries to also agree to a 21% global minimum corporate tax rate as part of the G20 and OECD negotiations, and already France and Germany have agreed. As C4TF reported, Canada would gain over $11 billion annually from a global minimum corporate tax rate at 21%, but neither Prime Minister Justin Trudeau nor Finance Minister Chrystia Freeland have said they support the proposal.

- Close loopholes and deny deductions for multinationals offshoring, inverting or using tax havens as their residence. Biden and Yellen are planning to close a number of large loopholes that allow corporations to shift their profits to other countries, and to benefit from offshoring and use of tax havens.

- Eliminate tax preferences for fossil fuels, require polluting industries pay for the costs of clean-up and provide tax preferences for environmental investments. Biden is planning to move forcefully to eliminate tax preferences for fossil fuels, something that Canadian governments have been dragging their feet about for many years, while providing direct subsidies to fossil fuel projects

- Ramp up enforcement against corporations and invest in the IRS to go after tax cheats. They expect that an additional $80 billion over 10 years for the IRS to ramp up enforcement against corporations and high-income tax cheats will generate $780 billion in additional revenues.

The President’s American Families Plan includes measures to:

- Restore the top federal tax rate for individuals back to 39.6% from 37%, to which it was cut under former President Trump. States add from zero to 13% to these top income tax rates, and some cities add on their own income taxes as well.

- Double the tax rate on capital gains for those with over $1 million in capital gains, from 20% to 39.6% so they are taxed at the same rate as working income, and in fact by more with additional payments from the wealthy to fund Obamacare. Lower tax rates on capital gains are the biggest loophole for the wealthy in Canada as well as the U.S, and a big driver of inequality. A number of US billionaires—Warren Buffet, Bill Gates, Bill Gross—have called for preferential treatment of capital gains to end. The Canadian government loses well over $20 billion annually because of preferential tax treatment of capital gains with provinces losing billions more.

- Eliminate tax breaks for the wealthy. Biden’s tax plan would also eliminate the carried interest tax benefit that wealthy private equity fund managers exploit, and eliminate the “step-up” basis that allows wealthy individuals to avoid taxes on the increase in value of their estates. Biden promised to expand the estate tax so it would apply to inherited estates of more than US$3.5 million.

While not including wealth taxes or an expansion of estate taxes - at least not yet, the Biden administration is demonstrating enormous international leadership in stopping and reversing a global race to the bottom on taxes for large corporations and the wealthiest individuals, while setting a new trend for use of public funds to create jobs, help lower and middle-income families, and sustainably rebuild America. It’s not every day that the United States makes Canada look sluggish on progressive tax and public investment issues, though other countries are already way ahead of us both. Canadian leaders would be well-advised to feel where the winds are blowing, and follow President Biden’s example.

Toby Sanger