Résumé

Canada could gain at least $11 billion annually from a global minimum corporate tax levied at a 21% rate on the undertaxed profits of multinationals.

Revenues would be even higher with reforms that more equitably distribute multinational corporate profits between countries on the basis of real economic factors.

While other countries, including the United States, have made significant proposals for reform, Canada has been largely silent. It’s time for Canada to express support for substantial, effective and equitable reforms to ensure that multinational corporations pay their fair share of taxes in Canada and around the world.

Rapport

Canada could gain an additional C$11 billion+ in annual revenues from a global minimum corporate tax rate for multinational corporations at the 21% rate as proposed by US President Joe Biden, according to a study released today.1

We would gain an additional $19 billion+ in annual revenues from the undertaxed profits of large multinational corporations such as Google, Facebook, Apple, Walmart and many others if this global minimum corporate tax rate were set at 25%—the rate proposed by the Independent Commission for the Reform of International Corporate Taxation (ICRICT) and close to the average 26.5% corporate tax rate that applies across Canada.2

Revenues would be higher if the minimum corporate tax is combined with measures to fairly allocate the corporate profits of multinational corporations between nations, as included in the Minimum Effective Tax Rate (METR) proposal.

These estimates show that Canada would raise significant revenues from a global minimum corporate tax at rates similar to existing national corporate tax rates.

Annual Revenue Gains to Canada from a Global Minimum Corporate Tax:

(Figures in CA$ billions)

|

Minimum Corp Tax Rate |

OECD GLOBE Tax |

METR |

|

15% |

$6.88 B |

$13.24 B |

|

20% |

$11.56 B |

$17.35 B |

|

25% |

$19.29 B |

$22.63 B |

|

30% |

$27.43 B |

$26.38 B |

Note: Estimates from Cobham A., Faccio T. et al (2021): "A Practical Proposal to End Corporate Tax Abuse: METR, a Minimum Effective Tax Rate for Multinationals" IES Working Papers 8/2021. IES FSV. Charles University. https://ies.fsv.cuni.cz/sci/publication/show/id/6412/lang/en

U.S. President Biden and Treasury Secretary Janet Yellen recently released a Made in America Tax Plan with important reforms that would ensure that large corporations pay their fair share of taxes. One is to ensure that US multinationals pay at least a 21% tax rate on their foreign profits and prevent them from dodging tax using tax havens. This minimum tax rate on foreign earnings would still be below Biden’s proposed 28% income tax rate for domestic corporations.3

Similarly, a global minimum corporate tax as proposed through the OECD would apply to the foreign earnings of multinationals. Individual nations would remain free to set their own domestic corporate tax rates, which could be higher or lower than the mutually agreed-upon global minimum corporate tax rate.

DYSFUNCTIONAL CORPORATE TAX SYSTEM

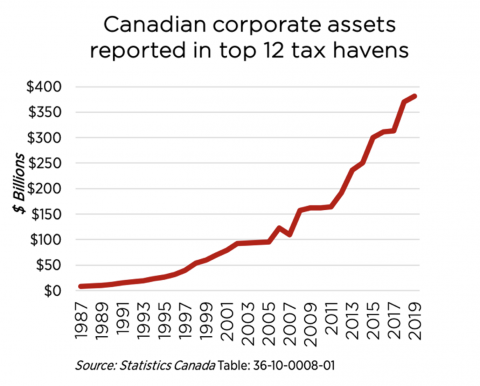

Multinational corporations have increasingly avoided paying corporate taxes by shifting their profits to tax havens and low tax jurisdictions. Large corporations such as Apple, Amazon, Google, Facebook, Walmart, Uber and many others have notoriously exploited tax havens and holes in the international corporate tax system to pay very low rates of tax.

This has resulted in an unfair tax system that favours the largest corporations at the expense of smaller and medium-sized domestic firms. It has contributed to growing corporate concentration, a less competitive business environment and growing inequalities of wealth. The vast majority of billionaire wealth comes from their corporate and business interests.

After many decades with little action and wilful blindness to this growing problem, a number of individual countries and international financial organizations have finally got more serious about tackling this problem, in part because of public pressure. The International Monetary Fund (IMF) estimates that international corporate tax shifting costs countries around the world over US$600 billion annually, an average of more than 1% of GDP annually.4

LONG AND WINDING ROAD TO REFORM

Negotiations over global tax reform through the Organization for Economic Cooperation and Development (OECD) have resulted in limited reforms in recent years, but nothing substantial enough yet to have a significant impact. Negotiations over a more substantial package of reforms are expected to conclude by the middle of this year. The question is, will the reforms go far enough, or will they end up as a diluted set of half-measures?

Until President Biden released his tax plan and proposals in April, it looked like the OECD talks would end in failure, no agreement or worse: ineffective and marginal changes that would do little but further complicate the international corporate tax system and delay more fundamental reform for decades.

Canada and the other 130+ countries involved in global corporate tax reform negotiations through the OECD have already agreed in principle to a minimum global corporate tax rate as part of a package of international corporate tax reform measures, but haven’t yet decided on a rate or how broadly it would apply.

A global minimum tax is just one of the reforms under consideration at the G20 and OECD meetings. As important are other issues: what corporations a minimum tax would apply to, whether it would apply to all their profits, how their taxable income would be calculated, how it would interact with other national taxes, what could be excluded from it, and, crucially, how the taxable profits and taxes of MNCs would be allocated between countries. Each of these is a matter of intense and complex negotiations.

Unfortunately, the OECD has gone down the route of trying to please everyone by combining elements of all different proposals in their unified proposal and Blueprint, instead of more fundamental reforms. It is questionable if the set of proposals in the OECD’s unified proposal could in fact be implemented. And if they could be agreed upon by over 130 nations and implemented, they would make the international corporate tax system far more complicated, layering multiple and likely contradictory rules on top of the existing out-dated and broken system.5

BETTER ALTERNATIVES

A better option would be more fundamental reform, replacing the widely-abused transfer pricing system with the simple system that Canada, the United States and other federal countries use to allocate each corporation’s taxable income between provinces and states: a “Formulary Apportionment” (FA) based on their share of real economic factors—such as the payroll, fixed capital and sales—based in each country.6

Another better option would be the Minimum Effective Tax Rate proposal as developed by Picciotti et al. This would be a much less complex, more practical and more equitable version of the OECD’s Global Anti-Base Erosion (GLOBE) Tax. The METR proposal could also be adopted by individual nations or a coalition of countries under current tax treaties, and wouldn’t require universal adoption through a multilateral tax convention as the OECD’s GLOBE proposal would.

The United States has also recently proposed to widen the OECD’s proposals to include more than just digital businesses with consumer-facing activities. The US proposal would cover the world’s largest 100 corporations, those with revenues of over US$20 billion annually, and allocate taxing rights by sales.7

WHERE’S CANADA?

While other countries including the UK, France, other European countries and now the United States have all taken proactive steps, Canada has done and said little. The Liberal government’s commitment to introduce a digital services tax if OECD negotiations don’t reach an acceptable solution is welcome, but the Canadian government should do much more to ensure that the OECD negotiations achieve significant and equitable reforms.

Given that Canada could gain over $11 billion annually from a global minimum corporate tax at a rate of 21% as proposed by US President Biden, it should strongly support this proposal.

The Canadian government should also strongly promote the broad adoption of an equitable formula for the allocation of taxable income of corporations between countries, just as we do between provinces in Canada.

Five years ago, former President Obama said that “The world needs more Canada.” It’s time that the Canadian government take a stand to support substantial, effective and equitable reforms to ensure multinational corporations pay their fair share of taxes in Canada and around the world.

ENDNOTES

1. Revenue estimates from Cobham A., Faccio T., Garcia-Bernardo J., Jansky P., Kadet J., Picciotto S. (2021): "A Practical Proposal to End Corporate Tax Abuse: METR, a Minimum Effective Tax Rate for Multinationals" IES Working Papers 8/2021. IES FSV. Charles University. https://ies.fsv.cuni.cz/sci/publication/show/id/6412/lang/en Figures in US dollars have been converted to Canadian dollars at a rate of 1.25$C to 1.00$US. See also Picciotti et al, For a Better GLOBE. METR: A Minimum Effective Tax Rate for Multinationals, 24 March, 2021.

2. These estimates of revenue gains for Canada from a global minimum corporate tax are in the same range as other estimates of the revenues that Canada loses from international corporate tax shifting. The International Monetary Fund (IMF) estimated that OECD nations lose an average of 1% of their GDP to international corporate tax shifting, which in Canada’s case would amount to about $23 billion. Canada’s Parliamentary Budget Officer estimated that Canada loses up to $25 billion annually to corporate use of tax havens and international tax avoidance.

3. US Department of Treasury, The Made in America Tax Plan, April 2021. https://home.treasury.gov/system/files/136/MadeInAmericaTaxPlan_Report.pdf

4. International Monetary Fund, Corporate Taxation in the Global Economy, 10 March, 2019. https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/03/08/Corporate-Taxation-in-the-Global-Economy-46650

5. Picciotto, Sol and Faccio, Tommaso and Kadet, Jeffery M. and Jansky, Petr and Cobham, Alex and Garcia-Bernardo, Javier, For a Better GLOBE. METR: A Minimum Effective Tax Rate for Multinationals (March 2, 2021). https://ssrn.com/abstract=3796030

6. Toby Sanger, “Canada can help fix broken international corporate tax system”, Policy Options, 3 July 2019. https://policyoptions.irpp.org/magazines/june-2019/canada-can-help-fix-broken-international-corporate-tax-system/

7. Biden administration widens digital tax push to target world’s 100 largest companies,” Smith-Meyer, Scott and Lorenzo, Politico, 8 April 2021.