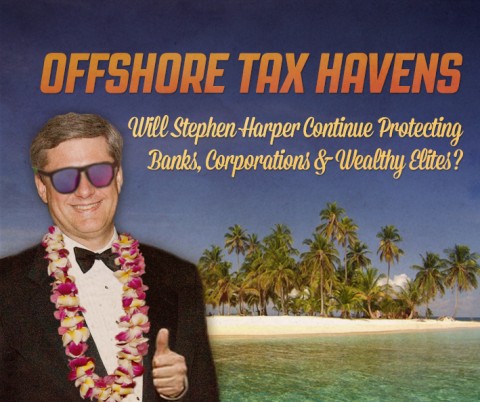

Canadians will continue to lose a minimum of

$7.8 billion a year if Prime Minister Harper and other members of the G8 fail

to agree on a plan to tackle global tax havens.

That’s the message Canadians for Tax Fairness executive director Dennis

Howlett will give to Monday's Finance Committee hearings on Bill S-17 related to implementation of tax conventions.

“In the six days the Prime Minister has been out

of the country, the federal government lost nearly $13 million in revenue –

just from not having a system in place. How is that good fiscal management?”

Howlett says.

Last

week, when he arrived in London, Harper indicated support for a system to track

if, and where, multinational corporations pay taxes on profits.

“Good

start,” says Howlett. “But for a plan to work it has to be comprehensive.

Nearly all of us pay our taxes and our government owes it to us to make sure

that the super-wealthy and multi-nationals are doing the same thing. There are

several other key measures that need to be agreed upon coming out of the G8.”

Bill

S-17 deals with bilateral tax treaties with a number of countries, including

several that are recognized as tax havens.

They are almost useless for exposing tax cheats using tax havens without

a global system for automatic tax information exchange.

Tax

haven use in Canada is at an all-time high with $170 billion – ten percent of

the GDP – socked offshore.