Facts

16 October 2023

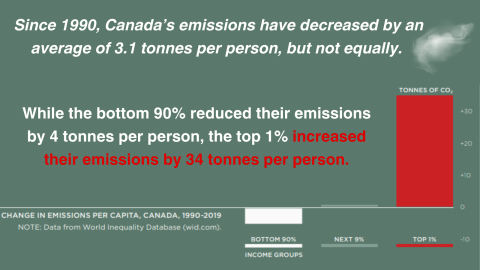

The biggest contributors to climate change have benefitted from a tax system that has allowed environmental costs to be downloaded and wealth to be concentrated at the top.

Fossil fuel corporations have increased profits and economic power – in great part by taking advantage of tax measures that have cost the public and the planet.

To achieve a just transition where benefits of the green economy are shared fairly, public investment must lead the way. Our report proposes more than a dozen tax and policy solutions to help the federal government get there.

The tax system can play a much larger role in bringing Canada closer to its climate goals while avoiding the same mistakes that exacerbated inequality.