For immediate release: February 11, 2026

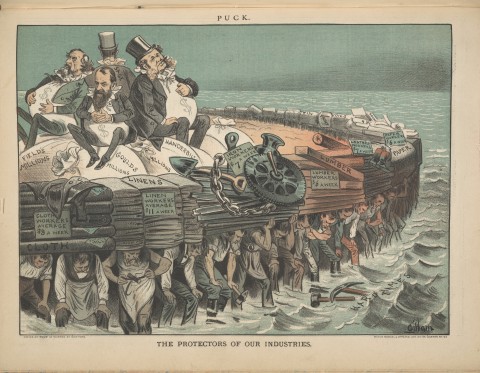

OTTAWA AND VANCOUVER—Wealth concentration in Canada has reached unprecedented levels since 1999, with the wealthiest 1% of Canadian families owning 22.7% of household wealth in 2023, up from 19.3% in 1999, according to a new report by Canadians for Tax Fairness (C4TF) and BC Policy Solutions (BCPS). The new robber barons reveals that the wealth of the 169,000 families that make up the top 1% increased by $3 trillion since the turn of the century, while the wealth of the 8.4 million families that make up the bottom 50% increased by only $757 billion.

“Because extreme wealth confers extreme power, this unprecedented concentration of wealth amongst so few poses a substantial risk to our democracy, our sovereignty, and trust in our institutions,” explained C4TF economist and policy analyst Silas Xuereb, a co-author of the report.

Report co-author Alex Hemingway, senior economist and public finance policy analyst at BCPS, added, “Thankfully, we have policy tools at our disposal to begin addressing the unprecedented crisis of wealth inequality facing Canadians. Implementing a progressive wealth tax on the top 1% and above, an inheritance tax, and closing the capital gains loophole would all re-orient our tax system towards equity.”

In Canada, as in most countries, wealth is extremely concentrated among a very small group and is much more unevenly distributed than income. The new robber barons addresses a long-recognized gap in Statistics Canada data—a failure to measure extreme wealth concentration at the very top. By combining Statistics Canada data with billionaire lists like the Forbes list, the report found:

- The wealthiest 1% of Canadian families (169,000 families), who have at least $7.8 million in wealth per family, owned 22.7% of household wealth in 2023, up from 19.3% in 1999.

- The wealthiest 0.01% of Canadian families (1,685 families) hold an average of $448.5 million, 4,041x the average wealth of a family in the bottom 50% in 2023.

- To return to the wealth distribution of 1999, the top 1% would have to transfer $560 billion to the bottom 99%, or $33,000 per family.

- Focusing on billionaires alone, the estimated 86 Canadian-resident billionaire families in 2023 held $286 billion in wealth, as much as 6.2 million families at the bottom of the wealth distribution—roughly equivalent to the value of all residential land in the City of Vancouver.

- The wealthiest resident family of Canada in 2025 was the Thomsons, with $93.9 billion in combined wealth. They were also the richest family in 1999.

“The warning is clear. We have an increasingly authoritarian United States threatening Canadian sovereignty economically and politically. To meet this challenge and avoid the fate of our closest neighbours, Canadians need to stop our slide into oligarchy and re-orient our economy and our democracy to work for all of us,” emphasized C4TF executive director, Jared A. Walker.

Canadians for Tax Fairness is a non-profit, non-partisan organization that advocates for fair and progressive tax policies aimed at building a strong and sustainable economy, reducing inequalities, and funding quality public services.

BC Policy Solutions is an independent, non-partisan research institute committed to advancing transformative policy solutions to the most pressing challenges facing people in British Columbia. Through research, convening and public engagement we seek to build a more just, equitable and sustainable future for all.

Media contacts:

For national media inquiries:

647-717-3094

For BC media inquiries:

604-802-5729