26 September 2019

To keep our supporters informed and connected, we send a newsletter with highlights of recent progressive tax developments in Canada and around the world. You can sign up to receive our newsletter here. Here is this week's roundup of tax fairness news:

Photo credit: Carbon taxes are an important part of the broader global solution, such as a transition to renewable energy, needed from all governments. UN Photo/Eskinder Debebe

THE FAIR TAX NEWS

26 September 2019

By Erika Beauchesne

Tax Fairness one of many tools to combat climate change

At the rapid pace of climate change, rising sea levels will swallow cities whole. Water sources will dry up, creating food shortages and air pollution will cause irrevocable health problems. It sounds like apocalyptic fiction, but it’s the stark reality hundreds of scientists warn is coming. Canada’s own scientists agree – 96 percent believe climate change is an emergency that requires immediate action, according to a poll this week from the Professional Institute of the Public Service of Canada.

The effects of climate change will be felt by everyone, a report from the UN expert panel on climate change confirmed this week. The warning comes on the heels of the UN climate summit, where advocates criticized world leaders for not doing enough to stop the climate emergency. A poll from Abacus Data found three in four Canadians support the climate strikes, a series of protests taking place across the globe as millions, many of them youth, protest inadequate response from government.

C4TF adds its voice to these calls, demanding Canada’s government use every policy tool available to scale up efforts against climate change. Continuing our countdown of the top five priority election issues as voted on by our supporters, this week we highlight how taxes play a critical role in combating climate change. Please share our fact sheet, which lists the fiscal steps our next government should take to tackle the crisis. You can also ask your local candidates if they support these measures, write letters to the editor, and sign petitions calling for climate action.

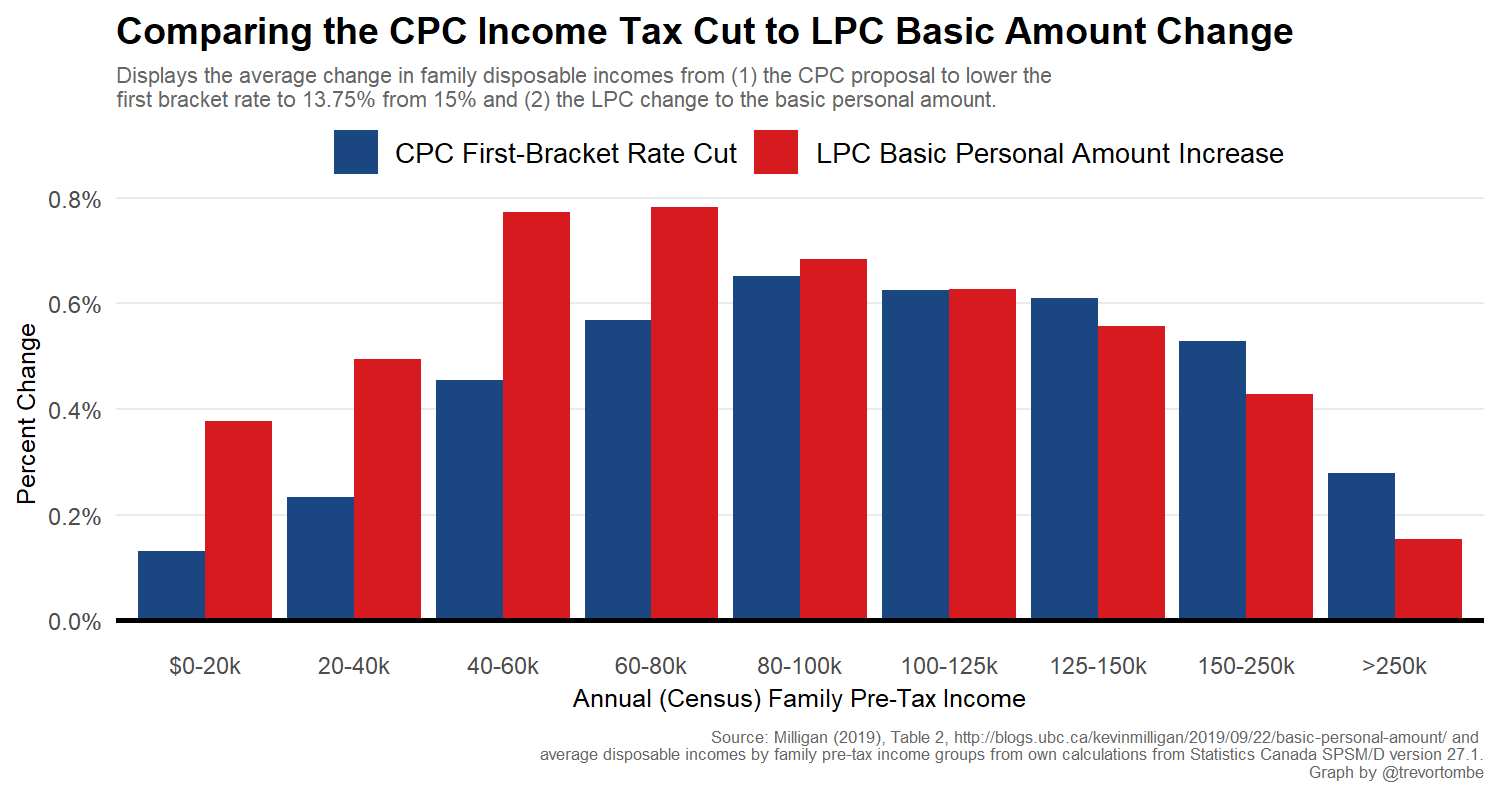

A graph by economist and University of Calgary professor Trevor Tombe pointing out the difference in progressivity between the two parties’ tax cut proposals. Trevor Tombe/Twitter

No one wins in duelling Conservative, Liberal tax cut pledges

Days after the Conservatives announced they would cut income taxes, the Liberals came out with their own tax cut promise: raising the basic personal income tax deduction from $12,069 to $15,000 for people earning less than $147,000. The measure would cost an estimated $5.6 billion once phased in by 2023 and save families $585 a year, the party says.

Comparisons of the two tax cuts show the Liberal version would be more progressive while the Conservative plan would benefit households as incomes go up, which we pointed out last week.

But both promises carry multi-billion-dollar price tags without providing significant help for families, as a Press Progress story reports this week. That amount of government spending could be better be invested in measures that help lower-income families such as direct benefits or affordable childcare.

An excellent column this week in the Toronto Star points out that politicians often woo voters with tax cut promises at election time, but as we’ve seen in the US, tax cuts don’t ensure a stronger economy or households that are better off.

Conservative Party leader Andrew Scheer this week announced he’ll back private corporation loopholes the Liberals tried to close a couple years ago. Flickr

Scheer promises to bring back tax breaks for millionaires

Conservative Party leader Andrew Scheer vowed this week to reopen tax loopholes for owners of private corporations that the government partially closed in recent years.

In 2017, the Liberals announced a series of tax reforms to prevent high-income earners, including doctors, lawyers, accountants, and business owners from taking advantage of the different tax rules for private corporations. Many of the proposals were eventually watered down due to pressure from industry. However, it did go through with changes to income sprinkling, which allows business owners to split their income among household members to pay less tax. A Canadian Centre for Policy Alternatives paper details the various problems with this loophole, whose benefits are concentrated among the richest Canadians. Those owning private corporations also benefit from a lower rate on passive investment income – savings it doesn’t spend on the business—which the Liberals capped at $50,000, recognizing that as being the average return on passive income of $1 million.

Business lobbyists protested the changes, framing them as an attack on small and family businesses, but as we pointed out in our 2017 myth-busting fact sheet, someone would need to earn at least $150,000 to benefit from these loopholes.

Multiple tax experts this week agreed. In a Twitter thread, UBC economist Kevin Milligan noted that the measures only affect the top 2.9 percent of private corporations, but get 88 percent of the passive income. The Conservative proposal would allow those with more than $1 million of investment assets to profit from their investments and shelter their savings and at far lower tax rates than other Canadians pay on their working income. “Why should only those private corp[oration] owners with specific family types have this tax break?” he asks.

Tax expert Allan Lanthier also points out in the Globe that in order to benefit from the changes, a small business would need more than a million dollars of portfolio investments that are not required in the corporation’s business. “So that’s not helping the plumbers, welders or the florist guy down the street.”

Even a column in the National Post warned the Conservatives’ plan “to simply return to the previous system, in all its garish inequity — and inefficiency — is utterly retrograde.”

The cost for fully restoring the income splitting loophole would be $30 million a year while ending the Liberal cap on passive investment income would cost $668 million by 2028-29, the PBO estimates.

In addition to draining revenues on measures that benefit the wealthiest, restoring these loopholes would further complicate the tax system, which in the same announcement, Scheer said should be simpler.

The Green Party is promising a number of progressive tax ideas this election such as taxing e-commerce corporations like Facebook and Google. Twitter photo

Tax fairness measures get billing on party platforms

The progressive tax policies we proposed in our Platform for Tax Fairness earlier this summer --and many recommendations proposed in the CCPA’s Alternative Federal Budgets in previous years—are being adopted in the parties’ platforms this election. The Green Party recently unveiled a series of tax promises, for which the PBO this week provided encouraging potential revenue estimates.

Some highlights include ending offshore tax dodging by corporations which the PBO estimates could generate $6.5 billion by 2020-21, taxing digital giants, and eliminating loopholes like the corporate meals and entertainment expense as well as ending write-offs for the fossil fuel industry. It also included in its platform, and a 0.5 percent Financial Transactions Tax on all transactions of equities, bonds and other financial transactions.

While there has been some criticism surrounding the costing of the policies, it is encouraging to see these progressive ideas in the Greens’ platform and the PBO calculations, which strengthen the case that important social programs can be paid for by making taxes fairer.

US Senator Bernie Sanders this week joined the growing masses who want to see a tax on wealth. Gage Skidmore, Wikicommons

Growing support for taxing wealth:

Bernie Sanders this week added his name to the chorus of politicians and rich individuals calling for a tax on wealth. The US Senator’s wealth tax is considered “tougher” than Senator Elizabeth Warren’s 2 percent tax on wealth over $50 million.

Sanders’ plan starts at 1 percent on wealth over $32 million but quickly rises to 4 percent on fortunes over $500 million. It’s expected raise more than $4 trillion in a decade while Warren’s is expected to generate $2.7 trillion.

Wealth isn’t stopping Sanders and other wealthy individuals from endorsing tax-the-rich policies. This week, Town and Country magazine profiled a Walt Disney heir who is leading the growing movement in favor of wealth taxes.

Canada’s NDP has proposed a 1 percent tax on wealth over $20 million and the idea is starting to stir some discussion. Sheila Block of the CCPA recently made some strong arguments for taxing wealth in a Toronto Star column with 70% of readers voting in favour, and an opinion piece in the Hill Times this week also argues it’s time to explore how governments can start to fairly tax capital.

Left to right: Attorney General David Eby, Premier John Horgan, Finance Minister Carole James announce a public inquiry into money laundering in BC. C4TF will take part in the inquiry with coalition members TI Canada and PWYP Canada.

Canadians for Tax Fairness to address money laundering commission:

After years of advocating for greater corporate transparency to fight Canada’s money laundering problem, C4TF and coalition members will take part in the upcoming Commission of Inquiry into Money Laundering in British Columbia.

The inquiry was called earlier this year after multiple reports confirmed the extent of the province’s money laundering problem.

Together with Transparency International Canada and Publish What You Pay Canada, C4TF will highlight how opaque corporate transparency laws have contributed to the epidemic known as ‘snow-washing’ in BC. Our coalition will also address how a public registry of beneficial owners –the real owners of companies—would help law enforcement, tax authorities, realtors, and the public combat money laundering.

This week NDP leader Jagmeet Singh announced three measures to combat money laundering and speculation, including the creation of a pan-Canadian beneficial ownership registry of corporations, trusts and partnerships that own land, a dedicated RCMP anti-money laundering unit, and a national Foreign Buyer’s tax of 15 percent on the sale of homes to foreign buyers to curb speculation.