25 April 2019

To keep our supporters informed and connected, we send a weekly newsletter with highlights of recent progressive tax developments in Canada and around the world. Please sign up here and share this newsletter with others.

25 April 2019

Canadian corporations reported they have over $350 billion in Canada’s top 12 tax havens around the world, in a Statistics Canada report released this week. That’s a lot of money: equivalent to almost $10,000 per Canadian.

Canadian corporations reported they have over $350 billion in Canada’s top 12 tax havens around the world, in a Statistics Canada report released this week. That’s a lot of money: equivalent to almost $10,000 per Canadian.

The Grand Duchy of Luxembourg topped the list for Canadian corporate money with $90 billion—or about $150,000 for each resident of the small but wealthy European tax haven. Barbados was next with $64.8 billion, followed by Bermuda at $47 billion and the Cayman Islands at $39.6 billion.

The actual amount Canadian corporations and wealthy individuals have sheltered in tax havens is estimated to be significantly greater than this, as this is just the amount that corporations report. Much more is hidden through shell corporations and by individuals. Still this amount means an annual revenue loss of about $3 billion.

In a news release, C4TF highlights the need for government to introduce tougher laws and penalties. Director Toby Sanger gets into more detail in an article in the Journal de Montréal about how little progress Canada has made compared to other countries in the battle against tax havens.

Rep. Alexandria Ocasio-Cortez talks about the need for a Green New Deal in the US. Credit: Wikimedia Commons, CC by 2.0

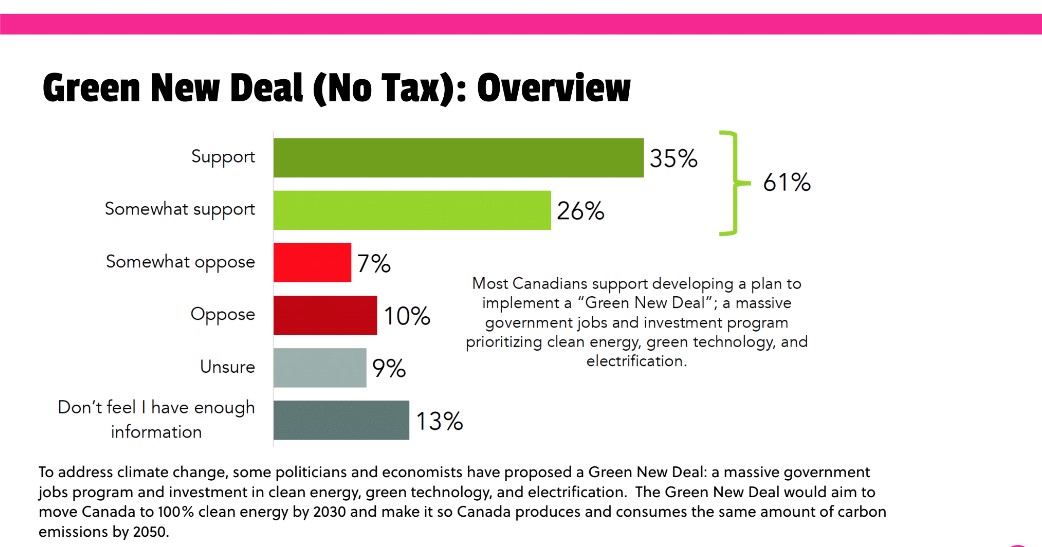

Poll finds support for higher taxes, green investment:

Most Canadians endorse a massive investment in green jobs and infrastructure -- and even more of us want to hike taxes on the rich in order to pay for it, according to a new poll by Abacus Data. The poll found 60 percent of respondents backed a Canadian version of the proposed American “Green New Deal” that would fund sustainable technologies and employment. When Canadians were asked how they’d feel about the plan if it required corporations and the wealthy to pay higher taxes, support spiked to 66 percent.

The Green New Deal is stirring discussion not only in the US, but globally, about the urgent need for environmental spending and how governments could collect the revenue to make that investment. Advocates have explored the benefits of having a Green New Deal in Canada and an op-ed in the Guardian this week proposes all OECD countries could collaborate on an international deal to fight climate change.

Dutch historian talks about taxes and his Davos moment

Dutch historian talks about taxes and his Davos moment

Anyone who enjoyed watching the antics of Rutger Bregman at Davos and on Fox News earlier in the year may be interested in reading this week’s profile of the Dutch historian by the International Consortium of Investigative Journalists—the same organization that has done so much to expose abuses of tax havens through the Panama and Paradise Papers. In this profile, Bregman addresses his amusing run-ins with the wealthy and how taxes are an underestimated tool in the movement against inequality.

CRA approves $133M write-off:

Someone in Canada got a $133-million write-off on their taxes owed, but the CRA will not disclose who --or which company—it was, according to a CBC investigation this week. The amount was for unspecified excise taxes or duties in the 2017-18 fiscal year. Beyond that, no information was confirmed by the agency, though the story suggests it likely was a write-off to the Chrysler Corporation. If so, it wouldn’t be the first. The government had previously provided a $1.1-billion write-off for the company, which recently announced plans for 1,500 layoffs at its Windsor assembly plant. C4TF and Canada’s own Auditor General have pointed out the need to close the gap between how government treats average taxpayers versus large companies.

Rich sheltered income ahead of tax increase: PBO

Rich sheltered income ahead of tax increase: PBO

At least $1.6-billion in potential revenue slipped out of government’s hands in 2016 after Canada’s highest earners shifted their income ahead of an announced tax rate increase. Those were the findings of the independent Parliamentary Budget Officer’s report late last week. In an interview with iPolitics, C4TF director Toby Sanger commented on how the forestalling of income is just one of many means and loopholes the wealthy can use to avoid paying their full share of taxes.

Time to make tax filing accessible to all Canadians:

It’s tax season and the mad rush to file before deadline is upon us. It’s a good time to ask why Canada hasn’t made the system simpler for everyone by adopting preliminary tax filing? Denmark was the first to experiment with the voluntary system of providing citizens with a draft tax return. Other countries have since come on board and C4TF has argued there’s no reason Canada couldn’t as well. An article in The Conversation this month points out that such a system wouldn’t win any fans from the profitable tax preparation industry, but ould save taxpayers money and time while reducing inequalities.