In an era of unprecedented crises, conversations around pandemics, global conflicts, inequality and climate change have become commonplace. Changes to global tax systems have been a big part of these conversations; bold solutions like a global minimum tax and wealth taxes are gaining support. Almost everyone has something to say. Well, almost everyone: Canada’s billionaires have been awfully quiet.

What are Americans saying?

In his recent address to the American people, U.S. President Joe Biden went strong on taxing the rich, “No billionaire should pay a lower tax rate than a teacher, a sanitation worker, a nurse.” But it’s not just politicians calling for increased taxes on the wealthiest people and corporations.

Some prominent U.S. billionaires appear willing to put their two (or trillion) cents in, too.

Last year, Warren Buffet proclaimed that “the 15 percent tax doesn’t bother me in the least”, referring to Biden’s proposed 15% minimum tax on book profits. Buffet went as far as to say that, “we do not think that corporations are overtaxed in the United States.”

Another prominent American billionaire also decided to speak on taxing the rich. During a panel discussion in January, Jamie Dimon, CEO of JP Morgan Chase said that it’s clear to him that low-income Americans need more financial support for the government and, “I would pay for it by taxing the rich a little more”.

Canada’s quiet billionaires

Canada’s billionaires are a little more shy with their opinion on tax fairness. David Thomson, 3rd Baron Thomson of Fleet, while prominent in the business world as the chairman of Thomson Reuters and its parent company The Woodbridge Company, is lesser known to Canadians.

Thomson’s reclusive nature has often been described in the rare but occasional article written about him.

But there’s another reason why David and family may be reluctant to speak publicly about taxes. The Thomson family sits atop a fortune built, in part, on tax avoidance. A 2023 report by Canadians for Tax Fairness revealed that from 2017 to 2021, Thomson Reuters had a whopping tax gap of $986 million. The Thomson fortune also passes through a complex set of inter-owning subsidiaries, some in known tax havens.

There are three identified tax haven subsidiaries among the companies held by the Thomson Family. Two tax haven subsidiaries are fully owned by Thomson Reuters Corporation: Thomson Reuters Finance SA and Thomson Reuters Holdings SA, both domiciled in Luxembourg.

Additionally, in 2022, Thomson Reuters reported $1 billion in revenue from a myriad of products offered to tax and accounting professionals, which represented an 8% increase over the previous year.

Time to speak up

Other prominent Canadian billionaires have come into the public eye to defend their wealth.

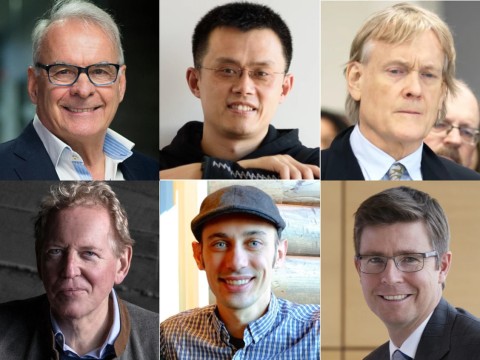

Jim Pattison, in 2021, warned that a wealth tax would lead to a Canadian capital exodus. Galen Weston, spent months defending Loblaws growing profit margins during an ongoing affordability crisis. Binance CEO Changpeng Zhao recently made headlines for violating US securities rules.

Outside of some of the more well-known Canadian billionaires, Canada’s billionaire class largely exists outside of the public eye.

With wealth inequality already at levels not seen in a century, and at a point where the top 10% of Canadians hold over 60 times the wealth of the bottom half, it's time for Canada’s silent billionaires to speak up.

Muneeb Javaid is the fundraising coordinator at Canadians for Tax Fairness