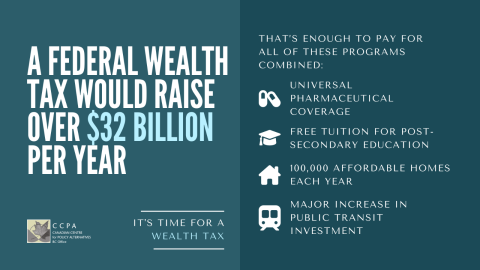

A wealth tax on the richest households in Canada would generate $32 billion in the first year alone, according to a new study by economist Alex Hemingway of the Canadian Centre for Policy Alternatives (CCPA).

The new revenue estimates are based on a 1% tax on households with net wealth above 10 million, 2% above 50 million, and 3% above 100 million.

Revenue would climb to $51 billion after 10 years, amassing a combined $409 billion. That would be enough to fund universal pharmacare and free postsecondary education while making major investments in affordable housing and public transit every year, CCPA calculated.

At a time when Canada needs to be making substantial investments to combat climate change and inequality, these latest estimates cannot be overlooked.

Our own research showed that between 2010 and 2019, only Canada’s top 1% increased their share of total wealth. The share of all other groups declined or remained the same.

A report by Oxfam earlier this year confirms the trend is continuing. A handful of the richest Canadians now have $249 billion in assets, more than all assets held by the bottom 40% combined.

Canada’s wealth gap has been exacerbated by an unfair tax system that has different rules for the rich than the rest of us. For example, while an average worker is taxed on every dollar they earn, only half of capital gains income is subject to tax. Tax havens and other tax loopholes allow the wealthiest Canadians to pay less tax than they should.

While unprecedented government support during the 2020 pandemic helped pull a million people out of poverty, Statistics Canada’s latest Canadian Income Survey Results show that poverty grew worse in 2021. As pandemic supports were withdrawn, nearly 500,000 people fell into poverty. With higher inflation, we can expect the data from 2022 to be even worse.

But as many Canadians were struggling with higher prices, others were reaping the rewards.

Our research shows corporations made record profits in 2021, contributing to inflation while also avoiding tens of billions in taxes. Many of these corporations also took government subsidies during the pandemic that were meant to help retain workers, but instead reduced employment, bolstered profits and spent $173.5 billion on dividends, share buybacks, and acquisitions. In other words, public money helped the richest members of society get richer.

We’re often told that Canada can’t afford to spend on social programs to help people and grow the economy. But the CCPA’s latest wealth tax estimates and our own research into corporate profits and tax avoidance confirm this is untrue. We have the money to make crucial investments in areas such as pharmacare and climate change mitigation but we need to tax wealth and profits fairly.

If you agree, sign our petition calling for the government to make wealthy individuals and corporations pay their fair share.