About this campaign

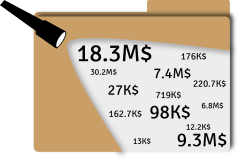

The federal government loses over $40 billion per year to tax loopholes - which doesn’t include the billions also lost by provincial and territorial governments.

That’s enough money to pay for universal pharmacare, improving long-term care, plus other important public services.

Almost all the benefits go to large corporations and very wealthy people instead.

Over 90% of Canadians, irrespective of political party affiliation, support closing tax loopholes used by the wealthy.