About this campaign

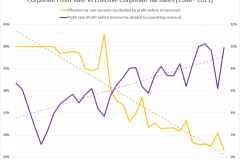

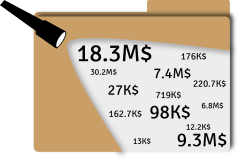

Canadian corporations are paying their lowest tax rates ever, despite all-time record profits, skyrocketing CEO pay and massive corporate subsidies. Canada has lost over $1.1 trillion dollars to corporate tax cuts since the year 2000.

That’s enough to pay for multiple years of full healthcare for all Canadians including pharma and dental care, fast-tracking the transition to green energy, abolishing student debt, revamping Canada's infrastructure, and more.

We advocate for policies including higher corporate tax rates, eliminating corporate tax loopholes, taxing corporations based on their book profits, strengthening international tax agreements, and taxing back excess profits from government subsidies.